Banking Partnership

Currency Exchange | Fiat Deposit | Cash Management

What is a Banking Partners

A banking partnership is an intermediary investment settlement relationship between treasury bank, third party processor, trading partners and banking partners.

How does Treasury Bank work with banking partners

- Treasury treasurers underwrites securities to provide funds and guarantee for all trading partners to provide products and service with in digital asset investments.

- Treasury Bank opens trust accounts with its banking partners in the name of and in benefit of a specific district community. This gives the all trading partners an opportunity to be a community program service agent and community residents to become investors with in digital assets investment utilizing digital cash vouchers

What are digital cash vouchers?

Treasury Bank works with banks the apply its digital cash voucher programs by utilizing QRC or Barcodes to collect funds, exchange currencies, and make deposits within a digital asset trust accounts.

A digital cash voucher is payment certification with a QRC printed on the voucher with cash letters that’s collected by banking partners base on their standard direct deposit procedures, using SFTP direct connection, wholesale lock box, secured email, digital voucher technology.

What is digital cash voucher technology?

Digital cash voucher technology allows Treasury Bank to utilize Quick Response Codes “QRC” with XML 20022 API mapping to preform EFT credit transfer data from an Internal Treasury accounts to external Money Market or Trust accounts with banking partners and trading partners as business transaction, outside of Regulation J. Each one of Treasury Bank’s Treasury accounts cash letters has their own Digital Cash Voucher for each individual transaction with trading and banking partners. Digital Vouchers can be reconciled globally when electronically scanned and processed for credit transferred into a bank’s core for deposit or merchant accounting via book entry.

This provides parallel account recognitions and reconciliations, and transactions for more secure and streamline audit trails.

How does Treasury Bank utilizes an Cash Letter?

A Cash Letter is utilized as a Treasury Bank declaration for Digital Voucher bank deposit from it Trading Partner. It is a digital file containing images of the Digital Vouchers and related data, submitted to a banking partners for processing instead of physically submitting the paper vouchers. This electronic method streamlines voucher clearing, reduces costs, and enhances efficiency for trading and banking partners.

Key aspects of an Cash Letter deposit:

- Electronic Submission:

Cash Letters are transmitted electronically, eliminating the need to physically transport vouchers. - Image and Data:

The Cash Letters file includes high-quality digital images of vourcher with Barcode of QRC printed or digital place on the voucher holding the associated data like account numbers, amounts, bank routing numbers, BIC, BIN and LEI. - Efficiency:

Cash Letters speed up the clearing process and reduce costs associated with shipping and handling checks. - Security:

Digital transmission and image technology enhance security and reduce the risk of fraud. - Flexibility:

ICLs can be used for various types of deposits, including mixed and sorted deposits. - Availability:

ICLs offer various availability options, such as same-day or next-day credit, depending on the chosen deposit type.

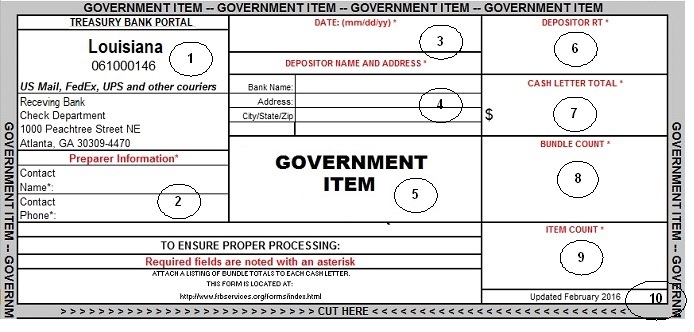

Cash Letter Form

How it works:

- Image Capture:

Digital Vouchers are scanned and their images are captured, along with essential data like MICR lines. - File Preparation:

The Digital Vouchers images and data are compiled into a digital file formatted according to industry standards (e.g., ANSI X9.37). - Transmission:

The Cash Letter file is transmitted securely to the recipient bank. - Processing:

The bank processes the Digital Voucher and credits the depositor’s account accordingly.

Benefits of using Cash Letters:

- Cost savings: Reduced shipping, handling, and labor costs.

- Faster processing: Expedited check clearing and funds availability.

- Improved security: Reduced risk of fraud and lost or damaged checks.

- Convenience: Easy and efficient online deposit process.

- Increased efficiency:Streamlined check processing and reconciliation

Exchange Rate:

Rates are based on banking partner standard currency foreign to domestic exchange rate at a 1:1 ratio.

TRANSFER OF FUNCTIONS DISCLAIMER

Deposits; exchange and collection; member and nonmember banks or other depository institutions; charges Any Federal reserve bank may receive from any of its member banks, or other depository in situations, and from the United States, deposits of current funds in lawful money, national-bank notes, Federal reserve notes, or checks, and drafts, payable upon presentation or other items, and also, for collection, maturing notes and bills; or, solely for purposes of exchange or of collection may receive from other Federal reserve banks deposits of current funds in lawful money, national-bank notes, or checks upon other Federal reserve banks, and checks and drafts, payable upon presentation within its district or other items, and maturing notes and bills payable within its district; or, solely for the purposes of exchange or of collection, may receive from any nonmember bank or trust company or other depository institution deposits of current funds in lawful money, national-bank notes, Federal reserve notes, checks and drafts payable upon presentation or other items, or maturing notes and bills: Provided, Such nonmember bank or trust company or other deposit tory institution maintains with the Federal Reserve bank of its district a balance in such amount as the Board determines taking into account items in transit, services provided by the Federal Reserve bank, and other factors as the Board may deem appropriate: Provided further, That nothing in this or any other section of this chapter shall be construed as prohibiting a member or nonmember bank or other depository institution from making reasonable charges, to be determined and regulated by the Board of Governors of the Federal Reserve System, but in no case to exceed 10 cents per $100 or fraction thereof, based on the total of checks and drafts presented at any one time, for collection or pay ment of checks and drafts and remission there for by exchange or otherwise; but no such charges shall be made against the Federal re serve banks. TITLE 12 § 342. For transfer of functions to Secretary of the Treasury, see note under Title 12 section 55 of this title.

Due a privacy restrictions Treasury Bank is a non federal reserve member and does utilize funds-transfer system of the Federal Reserve Banks. It transmit payment orders through other third-party communication system for transmittal to the bank, the system is deemed to be an agent of the it members and investments for the purpose of transmitting the payment order to the bank utilizing Electronic Funds Transfer as Peer to Peer Communication System in respect to banking partner compliance to Regulation J Section 4A-206.