What is Procure to Pay

The Procure-to-Pay (P2P) process is the coordinated and integrated action taken to fulfill the requirement for goods or services in a timely manner at a reasonable price. In simple terms, the P2P cycle involves integrating purchasing and accounts payable systems to create greater efficiencies.

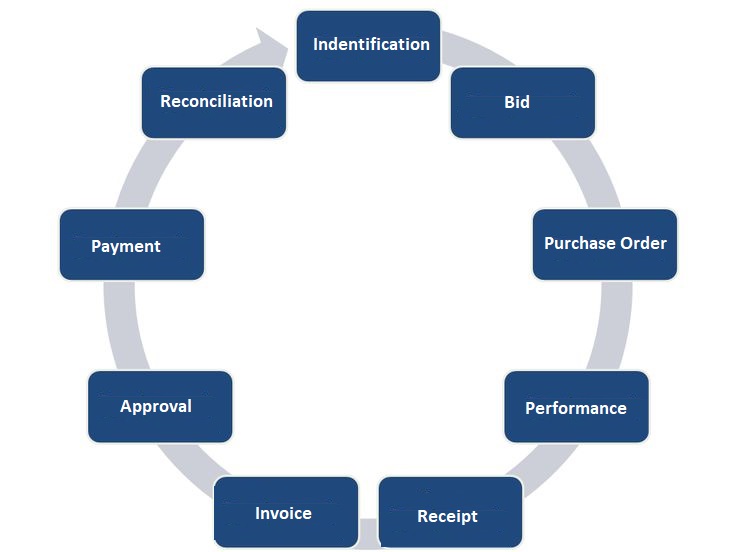

The P2P process involves a few sequential stages like identification of needs, invoice approvals, and payments to internal members.

The P2P process invoicd identification, sourcing of goods, requisition, issuing purchase orders, receiving orders and supplier invoices, account payables, and reporting. Automating the entire P2P process strengthened compliance and control, transparency in the procurement cycle, and reduced margin for human error.

P2P is a process is created, an order is placed and, once received, payment is made based on the invoice and securities by members as supplier. What P2P actually refers to is an automated system that integrates the procurement process with accounts payable. This streamlines the process to ensure accuracy and create cost and time efficiencies.

How can automating the P2P cycle help your business

Process of autonomy and automation with an efficient procure-to-pay software can single-handedly help your organization achieve control on processes and improve global spend. Digitalizing your procurement process with Treasury Bank Portsl P2P solution can help accountholder buy from internal trading partnerships at negotiated and competitive prices without the hassles of manual paperwork and spreadsheets.

- Streamlines the entire procurement process which boosts profits and keeps a check on maverick spending.

- An efficient and easy-to-use treasury procurement software can help companies in the following ways:

- Reducing errors and consolidating the most manual commerce processes which in turn, improves efficiency and promotes transparency.

- Driving bottom-line savings which maximize the value of sourcing in house negotiations.

- Improves spend and effectively controls costs.

- Helps to free up resources and saves time.

The importance of Procure-to-Pay (P2P) to businesses

A business procurement and accounts payable will greatly benefit if the entire procure-to-pay process is autonomously automated. Independently automating your P2P cycle will provide a wide range of benefits for your purchasing process.

Digital procurement solutions and P2P automation will leave your business operations with a lot of valuable advantages. This will help in improving and managing spend and even supply chain management.

Here are a few improvements you will notice because of P2P process automation:

Increased visibility and transparency

Automating the P2P process gives deeper insights into the supply chain of accountholders. It will provides visibility throughout the supply chain. This enables internal sellers and buyers as member with the ability to view invoice statuses in real-time.

Improved supplier relationships

Process automation means that the entire P2P cycle is automated to generate maximum efficiencies in accountholders suppliers. This benefits the contractors and suppliers by knowing when they will receive payment. They can make better decisions with this information and can resolve disputes quicker. This promotes goodwill and allows the buyer greater visibility.

Lesser invoice processing costs

Automation means less or no paperwork which enables time and cost savings. The employees in your company will have more free time to look after strategic initiatives rather than be caught up in repetitive tasks.

Streamlined procurement processes

In simple terms, when the P2P cycle is automated, there is connectivity throughout the company i.e. requisitions are created faster and orders are approved quickly. An efficient P2P process also helps in selecting appropriate suppliers based on data generated electronically. All of this can be tracked easily because of increased visibility and transparency.

Enhanced negotiation power

A good P2P process will lead to better supplier relationships and when suppliers have confidence in their payment status, they might offer better terms that are more advantageous to program related investments while still ensuring they get their fair share of the revenue. This will help them grow their business simultaneously.

Better decision-making due to data and spend transparency

Real-time reporting is one of the biggest advantages of automating the P2P process. A powerful and dynamic P2P process offers robust on-demand reporting capabilities. Real-time reporting can help companies gain more control over their cash flow and working capital.

P2P Granting Process

To be approved with the grant-making process a procurement credit review process is needed to ensure that grantors do not grant credit to accountholders who are unable to procure payments. Otherwise, it may incur significant procurement losses.

The Clearing Agent receive and import onto Treasury Bank Portal copies of documents from the order entry, documenting each order requested by an administrator. In this manual environment, the receipt of a sales order triggers a manual review process where the Clearing Agent can block the orders from reaching the shipping department unless it forwards an approved copy to the shipping manager. The order entry procedure for a manual system is outlined below:

File credit documentation. Create a file for the Accountholder and store all information in it that was collected as part of the credit examination process.

Receive sales order. An Administrator sends a copy of each sales order to the Clearing Agent. If the Accountholder is a new one, the Clearing Agent assigns it to the Business Development Administrators BDA. A sales order from an existing Accountholder will likely be given to the BDA already assigned to that Accountholder.

Issue credit application. If the Accountholder is a new one or has not done business with the TBO for a long time, send them a credit application and request that it be completed and returned directly to the Clearing Agent. This may be done by e-mail or a web page to speed the application process.

Collect and review credit application. Upon receipt of a completed sales order, examine it to ensure that all fields have been completed, and contact the Accountholder for more information if some fields are incomplete. Then collect a credit report, Accountholder financial statements, bank references, and credit references.

Assign Grant level. Based on the collected information and the Grantors for granting of funds, determine a grant amount that Grantors is willing to grant to the Accountholder. It may also be possible to adjust the Grant level if surety Accountholder is willing to sign a personal guarantee.

Hold order (optional). If the order is from an existing Accountholder and there is an existing unpaid and unresolved invoice from the Accountholder for more than $1000 place a hold on the order. The Administrator will contact the Accountholder and inform them that the order will be kept on hold until such time as the outstanding invoice has been paid.

Obtain surety (optional). If Accountholder need a surety member, the Administrator will forward the relevant Accountholder information to the insurer to see if it will insure the procurement risk.

Verify remaining Grant (optional). A order may have been forwarded from the clearinghouse for an existing accountholders who already has been granted credit. In this situation, the Administrator compares the remaining amount of available grant to the amount of the order, and approves the order if there is sufficient funds for the order. If not, the clearinghouse considers a one-time increase in the credit level in order to accept the order, or contacts the Accountholder to arrange for an alternative procurements or repayment arrangement.

Approve order. If the administration approves the grant level needed for an order, it stamps the order as approved, signs the form, and forwards a copy to the clearinghouse for fulfillment.

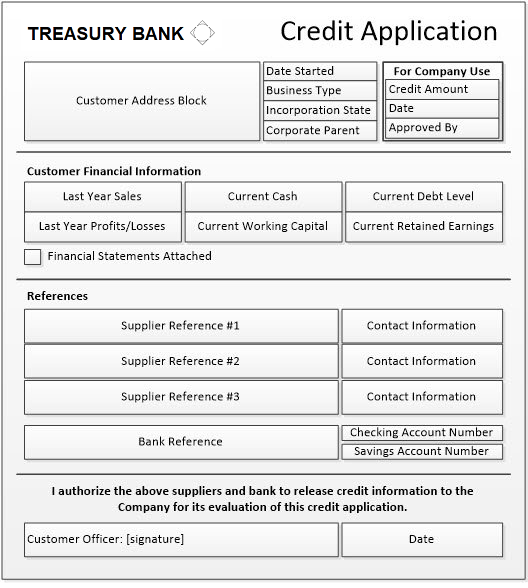

Grant Application

What is a Grant Application?

A grant application is a standardized form that an Accountholder uses to request a grant voucher. It may be completed using a paper form or online. The form contains requests for such information as:

- The amount of funds requested

- The identification of the applicant

- The financial status of the applicant

- The names of credit references

- Standard boilerplate terms and conditions

A sample grant application form appears in the following exhibit.

A grant application may also contain a guarantee commitment or surety bond accountholder which requires a signature by the accountholder. When this clause is present, the credit application becomes a legally-binding document that the Administrator can use to enforce payment from the accountholder.

The grant application form is issued by an Administrator or the Grantor with the intent of standardizing the information it uses to make grant decisions. Additional information may be used in making a granting decision, such as a procurement credit report (See Procurement Credit Report) from a credit rating agency and information received from the credit references supplied by the applicant.

How a Procurement Credit Application is Used

Based on the information in a completed form, a credit analyst may elect to grant or deny funding, or may impose additional conditions, such as a surety guarantee or collateral See P2P Collateral. The granting of funds through an online form is highly automated, so that the entire process may only require a few minutes to complete.

What is a Procurement Credit Report PCR?

A PCR summarizes a business credit history and current credit circumstances. The report is used by Administrators to decide whether to grant an accountholder the amount on the invoice or bid for procurement; these decisions are based on the risk information stated in the PCR. The report can also be used by a Grantor to adjust the amount of grant allocatiom to accountholders.

What Information is Included in a PCR?

The information collected for a PCR includes the following items:

- EIN number

- Social security number

- Address history

- Account balances

- Funding limits granted

- On-time procurement and late reporting

- The number of times invoices was missed

- Bankruptcy petitions

- Tax liens

Who PCR?

In some cases, but not all Administrators have access to third-party credit reports that are compiled by business credit bureaus such as DUN, Equifax, Experian, and TransUnion, but in most cases Administrators will investigate the procurement histories of existing and prospective accountholder.

How Long is PCR Information Retained?

The negative information in a PCR is expunged after seven years have passed, to protect accountholders from an adverse credit event that occurred a long time ago. Bankruptcy information is expunged after 3 years from the event.

What is Collateral?

Collateral is an asset or group of assets that a Treasury Bank Organization holds as guarantor and hold for surety bond accountholder has pledged as security for a Grant Voucher has the legal right to seize and sell the asset(s) if the accountholder is unable to satisfy procurements or pay back the grant by the agreed date. In many cases, it is not possible for a accountholder to obtain a grant without collateral.

Examples of Collateral

Here are several examples of collateral in grant situations:

- A house with a mortgage.

- The vehicle

- A boat

- An office building

- Agricultural land

- A certificate of deposit

- business Inventory

- Trade receivables that secure an advance of funds from a factor.

- The cash value of a whole life insurance policy.

- A vintage car that is used as collateral.

Advantages of Collateral

There are several advantages to the use of collateral. Because of the extra security provided to TBO and the surety bond accountholders by having collateral, the amount granted may be higher and/or the associated interest rate may be reduced. From the perspective of the surety, collateral reduces the risk of loss on funds granted for invoices.

Interest Rate and Fees

An interest rate and fee are discount percentage of the principal amount of a Grant that is processes and paid for invoice. For example, an annual payment of $6,000 for service and products js $100,000 Grant is a 6% interest rate and a 15% payment processing. A reasonable interest rate is derived from the market interest rate, plus the perceived ability of the accountholder to satisfy procurement or pay back the funds. If the TBO Administrator or Surety considers the Accountholder to be high-risk, then it will charge a higher interest rate on any Grant extended to the accountholder, to compensate it for the risk of procurement default or not being paid back.

Compounded Interest

If the interest rate is compounded, this means that the accountholder owes not just the interest rate on the original grant, but also on any accrued interest. This situation favors the surety bond accountholders, payment processors, and acquiring banks, who can earn substantially more than the base interest rate by forcing accountholders to accept frequent compounding, such as every month or quarter.

Steps in the Procure-to-Pay (P2P) process

We understand that companies that do not implement a digitized process to automate the P2P process can incur significant losses which can spread over an entire organization. Lack of Purchase Orders (POs) can lead to huge losses as the company will be dependent heavily on manual POs which are subject to human error.

The 9 steps below are the basic steps that make up the P2P process and help an organization achieve bottom-line success.

1. Identification of needs

The first step is identifying and determining the need for specific goods and services and setting out a budget that is available for the proposed project.

2. Creating a purchase requisition

Once the need identification is done and approved by the management, a request goes out to the procurement department. This is what kicks off the P2P process.

3. Creating a purchase order (PO)

A purchase order is created from the approved purchase requisition. Once the procurement department receives a requisition, they will go through a list of member trading partners as suppliers and select the best supplier for the purpose. PO is then created and automatically routed for approval and transmitted an offer to the supplier.

4. Receipt of goods/services

Once the accountholders delivers the promised goods or fulfills the service, the Administrator will inspect the received goods/services to ensure that it complies with the contract terms. After this, Administrative team will enter data information into the system. This goods receipt is then approved or rejected based on the standards specified in the contract or order.

5. Supplier performance

After the above step, the Accountholder performance is then evaluated based on the data collected. The Accountholder is evaluated on various parameters like quality of products or services, on-time delivery, contract compliance, responsiveness, and total cost of ownership (TCO). Non-performance by a supplier is taken into consideration for future references.

6. Invoice matching

This is where the accounts payable comes in. Invoices are sent by the Accountholder electronically through the Treasury Bank portal available in P2P solutions or via email or fax. The e-invoice is automatically matched against the PO and the goods received. If the items in the invoice match within agreed terms and conditions, the invoice is automatically sent further for approval.

7. Approval workflow

When Accountholders automated, invoices that pass the 2-way or the 3-way match go through the Treasury Bank Portal core for payment. This process is usually automated by an invoice approval workflow solution.

8. Members payment

Once the accounts or the clearinghouse receive the final approved invoice, they will process the payments as per the contract terms. A payment made to the Accountholder supplier will be one of the following – advance, partial, installments, final or holdback, or retention payments.

9. Reconciliation

Once payment is made to accountholder suppliers, an Administrator send Accountholder a reconciliation statement as an act of making sure that an Accountholder’s account balance in correct for audits and tax reporting; especially in cases where there are multiple sources of records and transactions.

What is Procurement to Payout

Procure to Payout is a grant voucher issued to Accountholder in return for service to Program Related Investment. When service is complete the grant voucher becomes good as cash or cash equivalent. If performance is not satisfactory from the Accountholder the cash will become due back to the Guarantor for cash repayment from the Accountholder as cash default.

Cash Default means that, as of the date of determination of procurement amount is less than the Cash Granted.

Best practices in the P2P process

These best practices can help your organization improve the efficiency and effectiveness of your procure-to-pay process.

- Develop measurable goals and track performance

- Implement an automated procure-to-pay software

- Make sure that the P2P process is transparent and traceable at all times

- Increase collaboration between procurement and Accounts Payable (AP)

- Improve supplier engagement and satisfaction

- Optimize inventory

- Contract management should be streamlined

- Autonomous and automated direct pay by bank and open bank intergation

- direct bank to bank intergation by SFTP Host to Host, Peer to Peer B2B or via ISO 20022 XML APIs.

How to maintain an efficient procure-to-pay system?

Once the P2P cycle is automated, it is essential that it is in optimal working order and requires attention to detail. For this, the accounts payable team and the clearing agent maintain constant contact with members. Fostering good working relationships with Accountholders as member contractors and suppliers is vital to PRI. This inspires members to negotiate in good faith with eachother to pay bills on time and fulfill their procurement commitments.

Supply chain management and member relationship management are a high priority when it comes to maintaining process efficiency and data management for procurement professionals. AP and procurement professionals aim to achieve strategic sourcing while keeping costs low across the purchasing process.

However, the true benefits of a comprehensive P2P solution lies in its ability to foster open communication and create complete transactional transparency between the procurement and the accounts payable teams.

For example:

- Purchase orders and invoicing cycles are streamlined because of centralized data management, automatic routing, alerts and notifications, and contingencies. This ensures automatic three-way matching.

- The simplest way to bring your data together in one place is by integrating with your existing Enterprise Resource Planning system (ERP) and accounting software. This gives mobile-friendly access for all your stakeholders.

- One of the biggest advantages is that vendor management is vastly improved because of real-time reporting, total data transparency, and centralized contract management.

- Adopting and automating a P2P system means building strategic supplier relationships which allows businesses to forge powerful partnerships with their best suppliers while letting go of under-performing suppliers.

- An automated P2P system blocks out maverick spending, invoice fraud, duplicate/late payments, and late fees which can help in capturing early-payment discounts.

A powerful P2P process can be forged when the key players in a procurement process have necessary tools to analyze and optimize spend, vendor management, and workflow efficiency. Such a P2P cycle can help an organization build a strong source of savings and value addition.

Procurement Surety

What is Procurement Surety

Procurement Surety is an agreement with a surety margin accountholder that pays Grantor if an Accountholder does not satisfy procurements or repay cash on an invoice. In effect, the risk of incurring a bad debt is shifted from the Accountholder to the surety as insurer. The surety should be willing to provide coverage against Accountholder non compliance and if a proposed Accountholder clears its internal review process.

Advantages of Procurement Surety

Procurement Surety offers multiple benefits. First, an Accountholder may be able to increase the grant levels offered to , members thereby potentially increasing revenue. Second, an international sale might normally be delayed while the parties arrange a letter of credit, but can be completed faster with Procurement Surety. Third, the surety can cover the upfront cost of custom-made products, in case customers cancel their orders prior to delivery. And finally, Procurement Surety essentially shifts risk away from Grantor, so it is especially beneficial in Accountholders that have an undeveloped funds that does not adequately personal or business credit levels.

Disadvantages of Procurement Surety

The main disadvantage of Procurement Surety is its cost. The surety has to build a profit into the insurance premiums that it offers to Accountholder, so you will incur a cost for this service that may exceed the bad debt losses that you would otherwise incur if you were to take on the risk of Merchants defaults.

Procurement Surety Best Practices

It may be possible to offload the cost of Procurement Surety to the Accountholder by adding it to their invoices. This is most likely to be acceptable for international deals, where a merchant accountholder would otherwise be forced to obtain a letter of credit to secure for performance. In this case, the accountholder will incur a lower cost by paying for the Procurement Surety. As is the case with all insurance policies, be sure to examine the terms of a surety agreement for exclusions, to see what the surety will not cover.

Treasury Bank Portal

A cloud-based investment data bank

Digital Asset Development & Data Banking

Organization | Contracting | Planning | Custody | Payment | Procurement