Grant Facility

A payment gateway for grant award and reward program for digital assets, liabilities, and equities

Direct B2B Transfer

Grant allocations are transferred between the Treasury Bank Portal and its banking partners; through utilizing P2P, B2B, A2A methods via EDI, XML API or web hooks transaction with or without standard clearing intermediaries.

- Push methods: Credit transfers by sending funds

- Pull methods: Debit transfer by retrieving funds

Dynamic QRC

Authorized Push Payment via Quick-Response Code messaging for safe Electronic Funds Transfer.

Secure and Direct Barcode Fund Transfer

- Electronic Funds transfer via B2B direct ERP core systems for Digital Asset Investment settlement with online or desktop QRC scanning.

- Provided detail KYC, EDD, CDD, and OFAC data to assure up to date transaction data to comply to all AML compliances.

- Closed looped matching and comparing transaction records ensuring investment expenses are paid accurately with less risk.

This is a physical ‘stored value card’ or ‘digital gift card’ with cash credit secured or unsecured features, used for Treasury Bank’s merchants expenses. It comes with a favorable periodic interest rates for third- part processors.

Electronic Payroll Grant

- Our QRC and Card payables are straight through digital exchanges.

- Transactions are automatically paid as employer for labor expenses.

- Funds are distributed as an international payment

Community Investment Vouchers

.

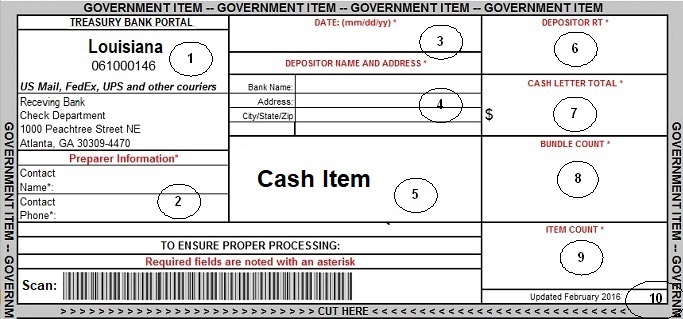

How Does It Work

1. Sending Voucher

Send vouchers to settlement bank via secure mail, email or wholesale lock box agnostic solutions

2. Process Voucher

Settlement bank processes Grant vouchers with post KYC BDD, CDD and OFAC methods

3. Posting Payment

Funds are credited to investment program or merchant’s settlement account in nation’s currencies

Processing Tools

Grant Card Reader

Grant Card Reader is ideal for card applications for bank secure network login. Dimensions: 0.38″H x 2.5″W x 3.25″D | gear (GSR212) USB.

QRC Barcode Scanner

Grant Facility’s ORC barcode scanner that can help treasury bank merchant’s acquiring bank read almost any type of 1D or 2D barcode.

Clearing

- Bank to Bank Credit Transfers

- Direct desktop proprietary clearing

- KYC, EDD, CDD, and OFAC compliance

- Risk Management & Due Diligence

- Investment Compliance

- Technical Support

Reporting

- Making funds transfer decisions and orders

- Automatic email notification of file creation -interface to SMTP servers

- Export Reports to Excel, Word, or PDF

- Full online and transparent audit trails

Q&A

What is a Grant Facility?

A Grant Facility is a payment gateway for certified receipt of cash credit that has been verified and accepted for value of performance which is worth an exchangeable monetary value in multi currencies and which may be exchanged for available national currencies within community investment program. A Grant Facility act as a Electronic Funds Transfer as grant transfer for business expenditures that has been made for service performed.

A grant transfer (e.g. “credit transfer”) is a payment transaction by which treasury bank’s payment services provider transfers funds to a payee’s account against a payer’s order, and the payer and the payee can be the same person standing order.

A standing order is a authorized push payment by which treasury banks sent a grant allocation via service provider, on the basis of a contract on the standing order with certain or determinable electronic funds transaction a certain or determinable amount from the members grant account as grant facility services. The contract on the standing order can be separately entered into or as a provision of another contract.

Benefits

- Wholesale Payment Routing

- Real Time Payment RTP

- Third Party Intermediaries

- More Privacy

What is Grant Facility Processing

Grant Facility processing is a sequence of actions facilitating secure fund transfers between a payer and a payee via Alternative Wholesale Routing. It encompasses the acceptance of both physical and digital payments at settlement bank as internal processing. This process involves settlement bank utilization of multiple processing sources and technologies, extending beyond credit cards to checks, mobile payments, and digital currencies.

Treasury Bank Organization payment processing system handles various transaction types, such as stored value credit cards, dynamic QRC electronic funds transfers (EFT), automated clearing house (ACH) transfers, digital wallets, mobile payments, and cryptocurrencies payments. Various stakeholders, such as banks, payment processors, technology providers, and regulatory bodies, collaborate to manage digital wholesale systems.

What is Dynamic QRC

Dynamic QR codes are a modern payment processing solution that allows for transaction-specific codes to be generated in real-time. Here are some key points:

- Dynamic QR Codes: These codes can be updated with transaction details, such as amounts, making them ideal for secure and efficient payments.

- Instant Payment Processing: Banking partners can scan the QR code, confirm the amount, and complete the payment instantly, eliminating the need for manual entry

- Security Features: Unlike static QR codes, dynamic QR codes prevent unauthorized use and provide tracking data, enhancing security.

Dynamic Wholesale Lockbox

Treasury Bank Organization send grant funds with embedded QRC printed on Grant Facility item directly to a secure post office box at settlement bank. The settlement bank will collect Grant Facility and process them by scanning the QRC and posting available funds to a settlement account as remittance.

What is a Grant Settlement

Grant Settlement is a grant payment in benefit of Community Investment Funds recipients as an electronic fund transfer to settlement account held at a settlement bank.

What is a Settlement Bank

A settlement bank, also known as an “acquirer” or “acquiring bank,” that works on the settlement end of the transaction. It assist with taking grant facility items from Treasury Bank to receive grant funds in a settlement account.

Treasury Bank work with settlement banks and it merchant setup a Settlement Account to work with a merchant business demand account at settlement bank. Both parties enter an agreement where the settlement bank and a third-party processor handle the details of merchants grant reward processing. The settlement bank will relay transaction information from the merchant as the card issuer’s with pre approved and pre payment card, QRC, or barcode methods. The payment clears through Treasury Bank as issuing bank associated with the issued merchant member’s card or QRC. It’s settled through the merchant’s settlement or acquiring bank.

What is a Settlement Account

A Settlement Account is established as a balance threshold funds for Community Investment Program as a designated zero balances sweep account to past-through member merchants investment cost and monthly service fees. Each Settlement Account typically serves an investment operational purpose for settlement fees, vendors and merchants payroll. It and can also be used to distinguish between departments or locations within a business.

Settlement Account Linkage will be linked to a merchants beneficiaries checking accounts to cover incoming debits, reduce interest expense, and improve cash flow.

Investment Options: Collected funds in excess of established target balances will be past-through to a community investors interest-bearing investment vehicle of choice at nightly processing to earn interest. Available funds will be swept back to your account to cover daily expenditures.

Who are Grant Facility Beneficiaries

Treasury Bank partner member are grant benefit by given opportunity to perform work on community investment program collecting investment discounting over the community investment program fund face value and term of the investment.

What is Grant Investment Discounting

Investment discounting is the process of determining the present value of the community investment, payment or a stream of payments that is to be received and processed through the settlement bank. Also understanding the intricacies of a payment processing system’s fees and pricing models for settlement bank for community Investment programs effectively.

Treasury Bank Organization’s allocated Settlement Account processing fees are:

Interchange Fees

Interchange Fees represent a fundamental component of payment processing costs. These fees are set by credit card networks such as Visa, Mastercard, or other payment processors, as well as issuing banks. They are non-negotiable and vary based on various factors, including the type of card used (e.g., credit or debit) and the risk level associated with the transaction. They often constitute a significant portion of a business’s payment processing expenses. As these fees are largely beyond a merchant’s control, it’s essential to be aware of their impact and plan accordingly. (See Interchange fees)

Assessment Fees

Assessment fees are another non-negotiable cost associated with payment processing. Treasury Bank or credit card networks establish these fees as fixed percentages pending closed or open loop of the transaction’s total value. Assessment fees support the maintenance and security of either Treasury Bank, the card network or both. These fees are inherent in the payment processing ecosystem and are necessary for facilitating electronic transactions. (See Credit Card Assessment Fees)

Payment Processing Fees

Payment processing are the intermediaries in the payment processing chain. These service providers charge businesses for their services, and the fees can vary widely among different providers. To effectively manage payment processing costs, merchants must comprehend the pricing structures payment processors use. Common pricing models include flat-rate pricing, subscription-based pricing, and tiered pricing. Each model has distinct advantages and disadvantages, impacting how much a business pays for payment processing services This is negotiated with the merchant and settlement bank.

Additional Fees

Beyond the core components of payment processing fees, members may encounter a range of additional charges. These include charge back fees, monthly statement fees, and PCI compliance fees, among others. These additional fees can significantly influence a correspondent bank’s overall payment processing expenses. This is also negotiated with the merchant and settlement bank.