Treasury Bank treasurers act as fund underwriters and payment agents for clients internal accounts at Treasury Bank and external Acquiring Bank. Payment are credit transfers as inter-bank movement of funds from a Treasury Bank’s receivable account as (debtor) account to a payable to beneficiary party as (creditor).

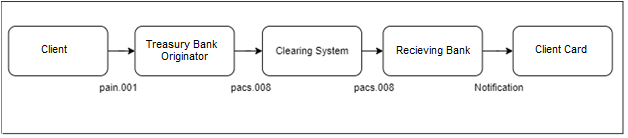

Treasury Bank credit transfers are exchanged as closed looped single or grouped transactions for privacy, convenience or efficiency reasons. The processing of credit transfers may differ from country to country and system to system; using ISO 20022 Pacs.008 credit transfers that will be sent when clients request Treasury Bank to send funds transfer to an account at the acquiring bank. As following:

- Clients may call or email to request a transfer over the counter or

- Clients may request payment through the web page or mobile banking API

- Clients are a corporation, may have your own ERP system and that is integrated with the Treasury Bank system and can request the payment through a pain.001 (payments initiation) message or

- Clients can request a payment through Treasury Bank proprietary integration with their acquiring bank that involve pacs.008

The above will result in outgoing pacs.008 from Treasury Bank

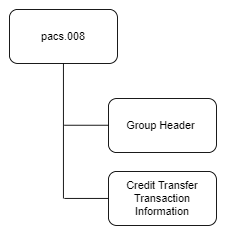

Structure

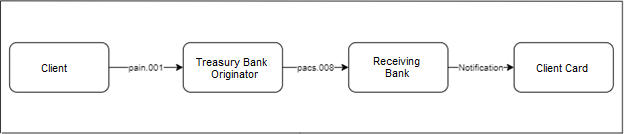

Message flow where Treasury Bank and Receiving bank are correspondents

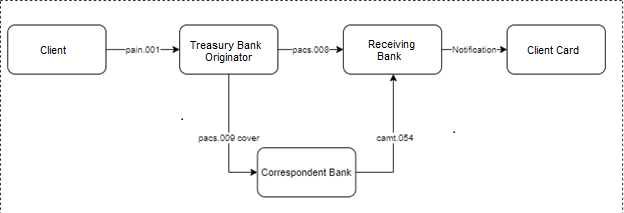

Message flow where Treasury Bank and Receiving bank are not direct correspondents and settled through cover payment

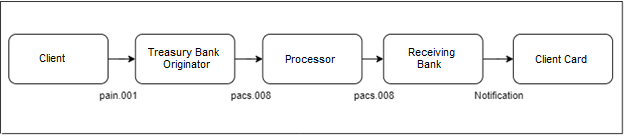

Message flow where the messages are routed through data processor (serial flow)

Message flow through HSC or ACH clearing system

Traditional Card Payment Transaction and Settlement Flow

- Card transactions flow between client, Treasury Bank banks (issuer), processors, recieving banks (acquirer) and , within a card association network.

- A cardholder initiates a card payment by presenting a payment card (or providing card details, such as the number and expiration date).

- The merchant’s payment system sends the card information to the acquirer or payment processor, which sends the information to the appropriate card network, which forwards it to the issuing bank for approval.

- The issuer approves or declines the transaction, sending the information back through the payment chain the way it came.

Treasury Bank’s Card Payment Transaction and Settlement Flow

Card transactions flow as Bank-to-Bank (B2B) as Credit Transfers

A cardholder is a merchant and client that initiates a card payment by presenting a payment card details, such as the number and expiration date.

The merchant’s sends its payment card requests to acquirer bank’s processor to pay other merchants with a Treasury Bank’s pre-approved identification and payment at acquirer bank processor.

How To Works

Unlike most banks, Treasury Bank Clients:

- are in-house investments contractors’ members with Treasury Bank

- have the same acquirer bank and processor

- Treasury contractors can only purchase from treasury bank members

- Transactions are internal book transfer at the acquirer bank’s processor

Closed Looped Account Transaction:

- Treasury Bank as funds originator

- SFTP Client act as Treasury Banks bank connector

- Trading Partners hold accounts with Treasury Bank and acquiring bank.

- Acquiring Banks is account holders and cardholders receiving bank and processor with the card association.

Treasury Bank begins with contracting clients, fund underwriting, deposit account opening with acquiring banks, and establishing control agreements with both banks. Treasures will also establish agreements with verify Treasury Bank to be fund originator as “Sender” and acquiring banks to be network processor as “Receiver.”

Clients of Treasury Bank and the Acquirer Bank are automatically pre-identified and approved for funds by both banks Ledger for cash positioning and easy reconciliation.

After Treasury Bank originates 1:1 direct credit transfer to acquiring bank all clients’ payment transfers are closed looped RTP payment date with internal card information as book transfers within acquirer core network as its internal payment processor with or without card network

Each bank Issuing responsibility:

- Treasury Bank issues payment certificate

- Acquiring Bank issues payment card

Client initiates a card payment by presenting a payment card only with other pre identified and approved client for settlement by the Issuer and Acquirer.

The card network only process payment within one acquiring bank internally.

Outside the Loop

- Any merchant payment outside the loop will be forwards to the appropriate card network with issuing bank pre-approval.

- Treasury Bank preapproval assures that payment will never decline within the network.

Tokenization

Tokenization is used to protect sensitive information. Tokenization involves a process of replacing credit card and account information with unique symbols, which creates a token. The token is not based on any known number in the original transaction such as a bank number, account number, or any other information tied to the customer.

Tokens allow retention of essential information about the transaction without compromising its security.

The following are examples of risks avoided that are associated with Treasury Bank payment cards:

- •Banks that use third parties to administer various aspects of customer card accounts are exposed to increased risks (e.g., operational, compliance, reputation) relating to the activities performed by the third party.

- All Prepaid verified cards are cash or cash equivalent account to void money laundering BSA/AML violations

- All cardholders are clients of both the issuer and the acquirer, so transferring of funds to or from an all account are unknown to avoid any KCY or CDD and EDD violations third party.

- Third parry integration has bank level security protocols to lower financial compliance risks that may exist due to multiple rules and regulations that apply. with card association rules and Regulation E.

Low Credit Risk

All credit transfers are one-way push credit transfers, which decreased credit risk by voiding potential fraud and charge-back activity. This is because all accountholders are directly between one closed connection with a issuing and an acquiring banks.

Benefit

Be apart of