Compliance

Handling risk management, due diligence, Investment compliance, chief finance services and fiduciary duty.

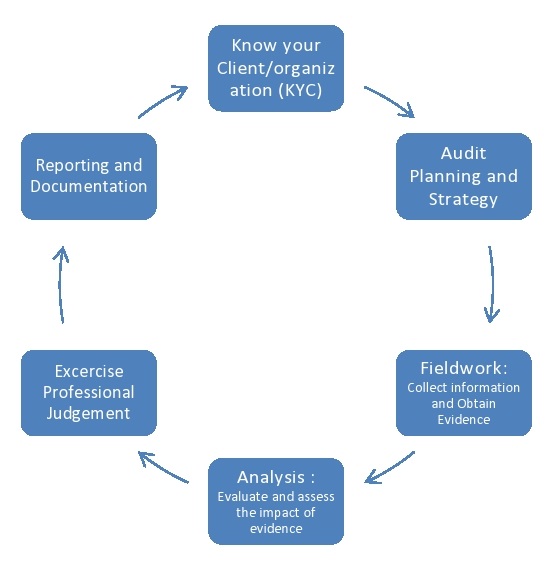

Treasury Risk Management & Due Diligence

Managing risk and due diligence by following policy and plans. Our clear agent focuses on the human element with background investigations. Performing professional due diligence to make sure that business is conducted correctly by members, their employees, their partners, and vendors.

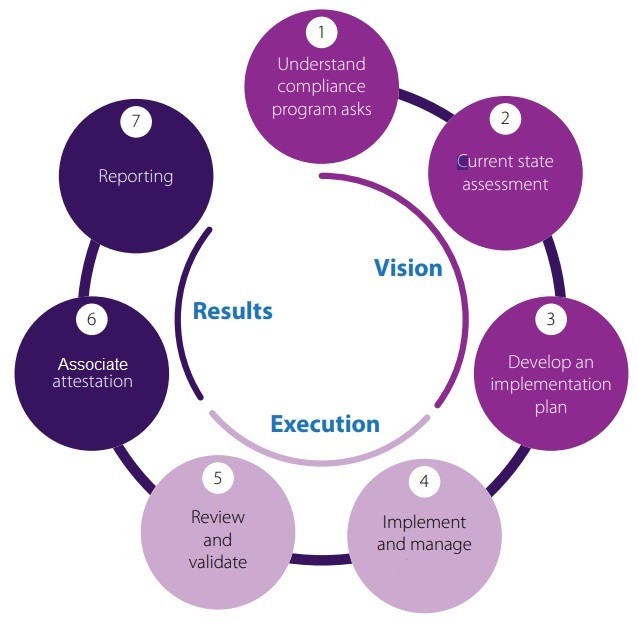

Investment Compliance

Applying Investment compliance by adhering to laws, regulations and internal policies and procedures, which govern the investment sector. This ensures that all investment is carried out in accordance with the rules and regulations set by regulatory authorities.

Chief Financial & Fiduciary Service

Trustee responsibility, checks and balance

Our fiduciary duties involve prioritizing our members interests over our own and avoiding conflicts of interest. This is to avoid liability lawsuits and financial risk penalties. Our compliance systems work to prevent breaches by maintaining clear rules, checks and balances, and regular organizational audits.

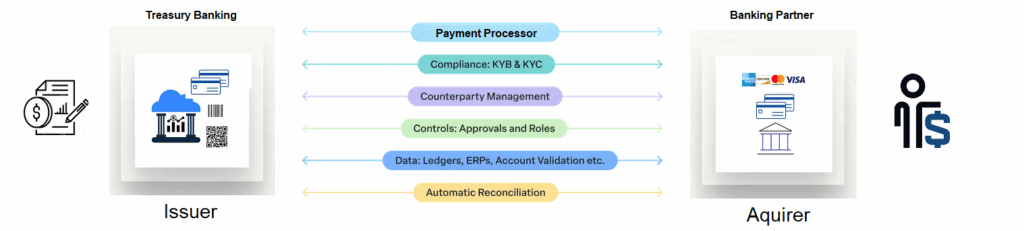

Data processors are treasury banking partners for it members multi level transfers.

Benefits

- Improved efficiency and privacy – straight-through transmission which avoids unnecessary intermediaries that compromise data

- Better data consistency – minimizes human error and data breaches

- Centralized financial management better procurement, invoicing and cash management.

- More accurate cash flow forecasting – more accurate cash flow forecasts.

- Faster Transfers – credit transfers in real-time P2P B2B outside of standard 1 to 10 days Swift, TCH, Federal Reserve, and ACH

- Minimizing Systemic Risk – less data intuition, fraud, and internal or external bad actors.