Discovery Meeting

For Intermediaries

By Chief Treasurer, Hillery Marcellus Scott

What Is Treasury Bank

An online Treasury Banking Institution

Treasury Banking means:

investment banking that provide centralized or decentralized treasury service to businesses and organizations

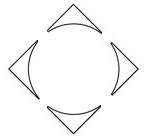

Our Seal

Treasury Bank Portal

Square– Treasury securities deposit and clearing.

Circle – intermediary bank circulation, collection and settlement.

The square and circle together represents digital asset portal for security deposit and liquidity as treasury and banking services.

Our Main Goal

Providing alternative and independent treasury banking services with the following:

- Business and Investment training

- Full-service investment platform

- Sourcd of proof and independent funding

- Consensus and procurement

- Managing investment risk for members

Operating Authority

Providing cooperative governance with the following parties:

- Administrative Board

- Investors

- Beneficiaries

- Community Leaders

- Banking Partners

Members

Treasury Bank offer 3 Member Levels:

- Guarantor – Business and Organization account level

- Fiduciary–

- Beneficiaries – Investment Associations | Contracting | Custody | Payment | Procurement

Treasury Bank Accounts

Treasury Bank offer 3 Membership Levels:

- Corporate–

- Development–

- Beneficiaries – Investment Associations | Contracting | Custody | Payment | Procurement

Membership Benefits

Grant Award & Reward

Providing programs related funds for business operational expenses

Electoral Investing

Leveraging centralized voting consensus for investment guarantee and assurance.

International Opportunity

Global circulation of income back to members treasury reserves.

Treasury Bank Accounts

Corporate

Design for business registration

Account Benefits:

- Business Certification

- Digital Asset Custody

- Business Support

$50 Monthly Fee

$500 Initial Underwriting

Development

Design for business development

Account Benefits:

- Business Certification

- Business Structuring

- Contract Development

- Business Plan

- Project Development

- Cash Management

- Digital Asset Custody

- Business Support

$150 Monthly Fee

Initial underwriting fee will apply based on business analysis

Investment

Design for business Investment grants

Account Benefits:

- Business Certification

- Business Training

- Business Structuring

- Contract Development

- Business Plan

- Project Development

- Cash Management

- Government Structure

- Trust Fund Services

- Security Tokenization

- Grant Allocation

- Digital Asset Custody

- Business Support

$250 Monthly fee

Initial underwriting fee will apply based on business investment analysis

Digital Asset Solution

Dematerialized data as centralized digital asset tokens and APIs

Professional Accountability

IFRS, IAS, and GAAP methods with CPA audits results

Investment Ledger

Validated account data and timestamp for proof of ledger import and export

Investment Account Incentives:

- Program Development

- Asset Management

- Securities Financing

- Credit Transfers

- Direct Debits

- Real-Time Payments

- CIP Card Program

- Compliance

- Audit Trails

Account Transfers

Treasury Bank Electronic Fund Transfer payment data to investors depository bank sponsors with the following tools

- Credit and Debit Card Issuing

- Card Settlement and Reconciliation

- Direct Payment as Credit transfer of funds from Treasury bank ERP to third party correspondence depository bank.

Key Concerns:

- cash management and internal expense for tax purposes

- internal risk base compliance

- Operate as a private entity that involve and trustee beneficiary relationship with consent of the client.

- Hold private equity and bond investment banking

- Insure that bank transaction are private and not state government.

- Ensure that clients will have record of offers and I have a recorded acceptance.

Mandatory Data:

Commerical Data Only (Non-Consumer)

- company name

- company business activity

- company ownership structure

- alternative business combination

- volume and types of transactions.

- planning for source of funds

- All beneficial owners of the accounts?

- financial position and banking references (New Start Up)

- KCY account holder with two year in good standing

- company domicile with the US

- No EDD Enhance Due Diligence, only CDD Customer Due Diligence for Private clients.

- US routine and primary trade area of transactions

- US base Company with no high-risk jurisdictions

- Commercial bank account money market depository a funds

- AML Policy and credit risk compliances

- MSB Registered and State exempted by act of law.

- Guaranteed ongoing risk-based CDD procedures

- EFT Rules

- type of funds will be deposited and EFT

- All clients have no financial fraudulent tax evasion record

- Have not neglected any financial compliance

- Client shall be within good stand with the state

- Internal On Us credit Nonbank’s credit or cash

- background checks

- onboarding documentation

- swap trading relationship documentation

- clearing exemption documentation

- account documentation

- tax consideration forms

- margining collateral or (ABS)

- other credit support arrangements. (Origination and Netting Agreement)

Key Compliance:

- Development Due Diligence

- Bank Security Firewall Endpoints

- Risk Management

- Cash Management

- Liquidity

- Procurement

Risk Management

Credit Risk

- Funds managed and credited Treasury banks and not by bank sponsors

- The Treasury Bank manages all risk associated with all accounts and the depository bank are responsible for their risk.

Market Risk

- Transaction are “Closed Market” 1:1 has no market risk of change in value

- Transactions are straight forward amortization.

- Transactions are screened with multi-level BSA/AML or OFAC due diligence methods.

Operational Risk

- Security agreements are warehoused with Treasury Bank and are not managed by the Depository Bank.

- Security agreements are originated by Treasury Bank and transferred to credit cards or bank money market or commercial account with the Bank.

- Funds are transferred and identified electronically via P2P to B2B and never handle by the depository bank employee

Regulatory Body:

- Self-Regulatory Organization (Public Authority

- SEC and Federal Trade Commission

- Payment Card Industry Standards

- Consumer Financial Protection Bureau CFPB

- Fin Cen, BSA and FFEIC

- Federal and State Agencies

Settlement Service:

Investment Bank to Bank payments using Host to Host integration with the following Payment File Formats:

Payment Files & Remittances Data Fields

Treasury Bank need financial payment data transferred to depository bank sponsors with the following 9 Standard Mapping Fields.

- Dollar Amount

- Debit or Credit Memo

- Beneficiary Bank ABA number

- Beneficiary Bank Name (optional)

- Beneficiary Account Number

- Beneficiary Name (optional)

- Beneficiary Address (optional)

- Originator Beneficiary Information

- Signature Guarantee Digital ID (Batch PIN)

- Addendums